Andy Groves begins his classic with the Schumpeter quote that it is not price competition, but the new commodity or technology that strikes at the foundation of existing firms. At that time Andy was teaching strategic management at Stanford. With time, the rules - environment change and these changes sneak up on leaders. The ability to recognize that the winds have changed before the boat is wrecked is important. Back in my boating days we would boat in my 18 footer from Hood Canal up to the San Juan Islands on a sunny windless day and camp overnight. The following day would often be cloudy and windy making the trip back hazardous. He notes you would like to detect significant changes earlier by being mindful of especially your organizations periphery. Like Nonaka, he points out that middle management are often the first to note the change and it their job to inform leadership. He warns to be careful not to inhibit this through fear by middle management of punishment. When confronted with change managers go through denial, anger, bargaining , depression , acceptance. Senior managers try to escape through diversions such as acquisitions. There is what he calls inertia of success otherwise known as the competency trap in which businesses continue what has been successful.

Andy Groves begins his classic with the Schumpeter quote that it is not price competition, but the new commodity or technology that strikes at the foundation of existing firms. At that time Andy was teaching strategic management at Stanford. With time, the rules - environment change and these changes sneak up on leaders. The ability to recognize that the winds have changed before the boat is wrecked is important. Back in my boating days we would boat in my 18 footer from Hood Canal up to the San Juan Islands on a sunny windless day and camp overnight. The following day would often be cloudy and windy making the trip back hazardous. He notes you would like to detect significant changes earlier by being mindful of especially your organizations periphery. Like Nonaka, he points out that middle management are often the first to note the change and it their job to inform leadership. He warns to be careful not to inhibit this through fear by middle management of punishment. When confronted with change managers go through denial, anger, bargaining , depression , acceptance. Senior managers try to escape through diversions such as acquisitions. There is what he calls inertia of success otherwise known as the competency trap in which businesses continue what has been successful.  One of Porters 6 forces - power of existing competitors, complimentors, customers, suppliers, substitutes and potential competitors, can become a 10x or superforce causing a strategic inflection point where business either increases or starts to decline depending on the actions of the firm. The point is not a point but occurs so gradually it is hard to detect. They approach with little cat feet. The change of the computer industry form a vertical industry dominated by IBM to horizontal took a decade. He discusses how Steve Jobs missed this change in '85 with Next which had designed a great obsolete vertical product for a new horizontal world.

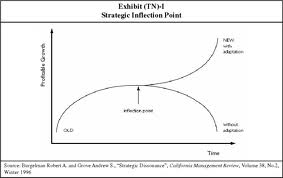

One of Porters 6 forces - power of existing competitors, complimentors, customers, suppliers, substitutes and potential competitors, can become a 10x or superforce causing a strategic inflection point where business either increases or starts to decline depending on the actions of the firm. The point is not a point but occurs so gradually it is hard to detect. They approach with little cat feet. The change of the computer industry form a vertical industry dominated by IBM to horizontal took a decade. He discusses how Steve Jobs missed this change in '85 with Next which had designed a great obsolete vertical product for a new horizontal world.Strategic inflection points are common. Other industries have undergone 10x changes including sales, shipping, patent medicines (in 1906 they took out the opioids) and some come through changes in regulations. The HMO Act of 1973 was a major change for HMOs. My biggest investing mistake was selling shares in a small HMO stock called United Healthcare in the early '80s. One challenge is distinguishing a signal from noise. One must decide is this a significant change? To tell, ask who your key competitor is. If this has changed it may indicate an inflection point. Ask if your complementors are changing. If people around you don't get it the it may have changed. "Learn what goes on at the periphery of your business." He recommends doing this through e-mail. However,he points out that the most important tool to detect an inflection point is debate among your staff.

It took Intel a year to decide to change direction from memory chips to microprocessors even though they were loosing money and the change implementation took three years.

Of course, when there is an inflection point it is not always obvious which solution will win.

Responses to change also include strategic dissonance where companies say one thing and do another. This occurs when middle managers are changing reacting to the situation but leadership hasn't caught on. This is resolved through experimentation which should be ongoing in the learning organization.

To reign in the chaos of change the first task of the leader is to create a vision of what focus the company should have in the future. For Intel it was a microprocessor company. Redeploying resources is done through strategic action. These are concrete steps, not plans. Timing and clarity are important and at an infection point strategy needs to be both top down and bottom up. The culture must tolerate debate and make clear decisions.

I is amusing that in the last chapter he explains the Internet and evaluates whether it will be a 10x change. He decides it will be.

Grove on change at Intel

No comments:

Post a Comment